What Taxing Crypto Means:

In the course of human evolution it has become apparent that legal tender systems such as the United States Dollar have the ability to become a world standard in compensation and trade. Even electronic versions of those fiat systems are very limited. The electronic process of tax collection within them is collected at best four times a year upon business payment submission. Most times tax payments are negated, delayed or avoided all together. In the USA this is a contest to see which business can create the most transactions and pay the least amount of tax; with Amazon coming in first place at 0 taxes per billions of dollars revenue yearly.

These taxes pay for roads, parks, public schools, fire departments, police stations and many other aspects of community life that we take for granted. The wealthy replace these items with privatization and personal contributions. As in private schools, security, home owners associations, private food pantries, etc. All while deteriorating the public aspect of these systems with control through justified non tax payment through write off’s.

Sometimes these are donations to public charities or causes. However most of the time this is written off through things like daily gas costs for the Amazon delivery fleet, or contributions to a private school of their choice; Not public! Don’t get me wrong; Yes, you are paying Amazon for gas in the Amazon delivery truck for 100%+ of the entire route. However when Amazon pays for the gas they keep the receipt, turn it in to the government, then based on municipality are issued a refund. Most of the time they are paid twice for delivery gas. This is just one, very small example of how businesses like Amazon treat the world community through fiat tax systems and achieve a net income of 33.36 billion (Statista) in 2021.

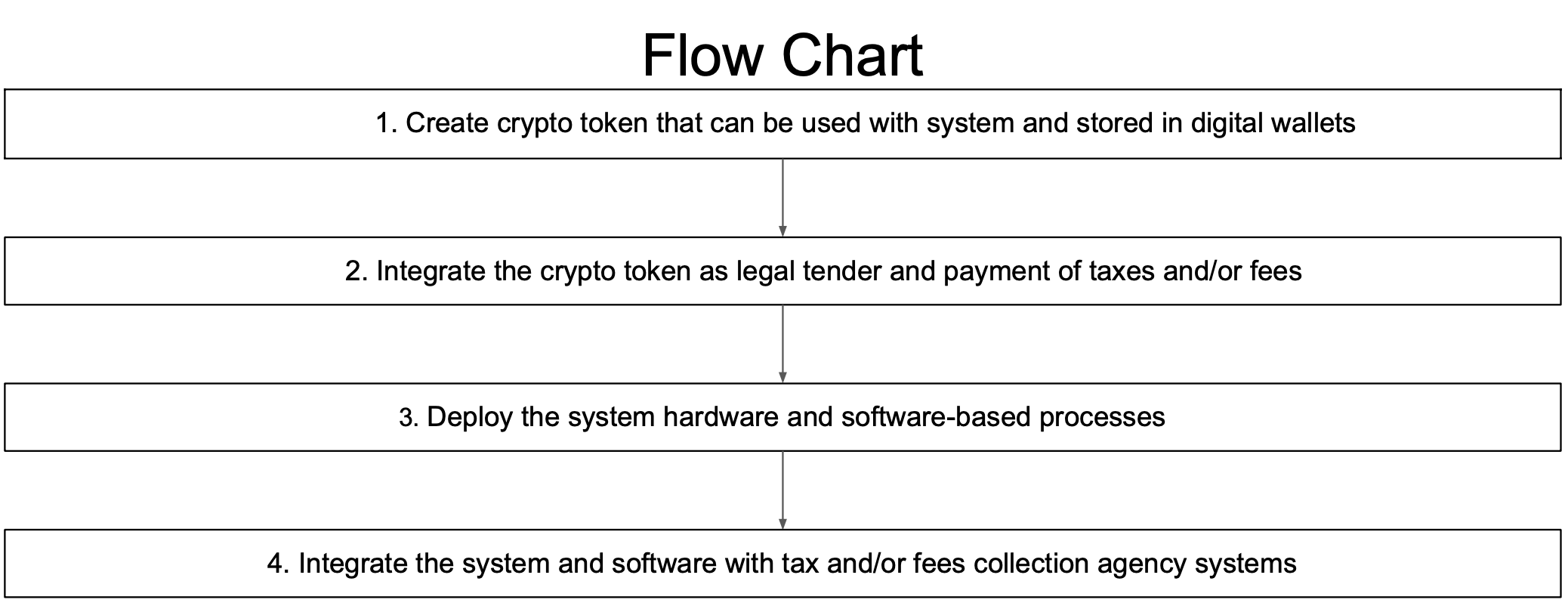

These companies aren’t going to regulate themselves and neither are their governmental in pocket beneficiaries. So with humility, humanity, world community, and the future of all in mind I have provisionally patented taxing crypto #63/314,246 (Download / Receipt). My patented process is:

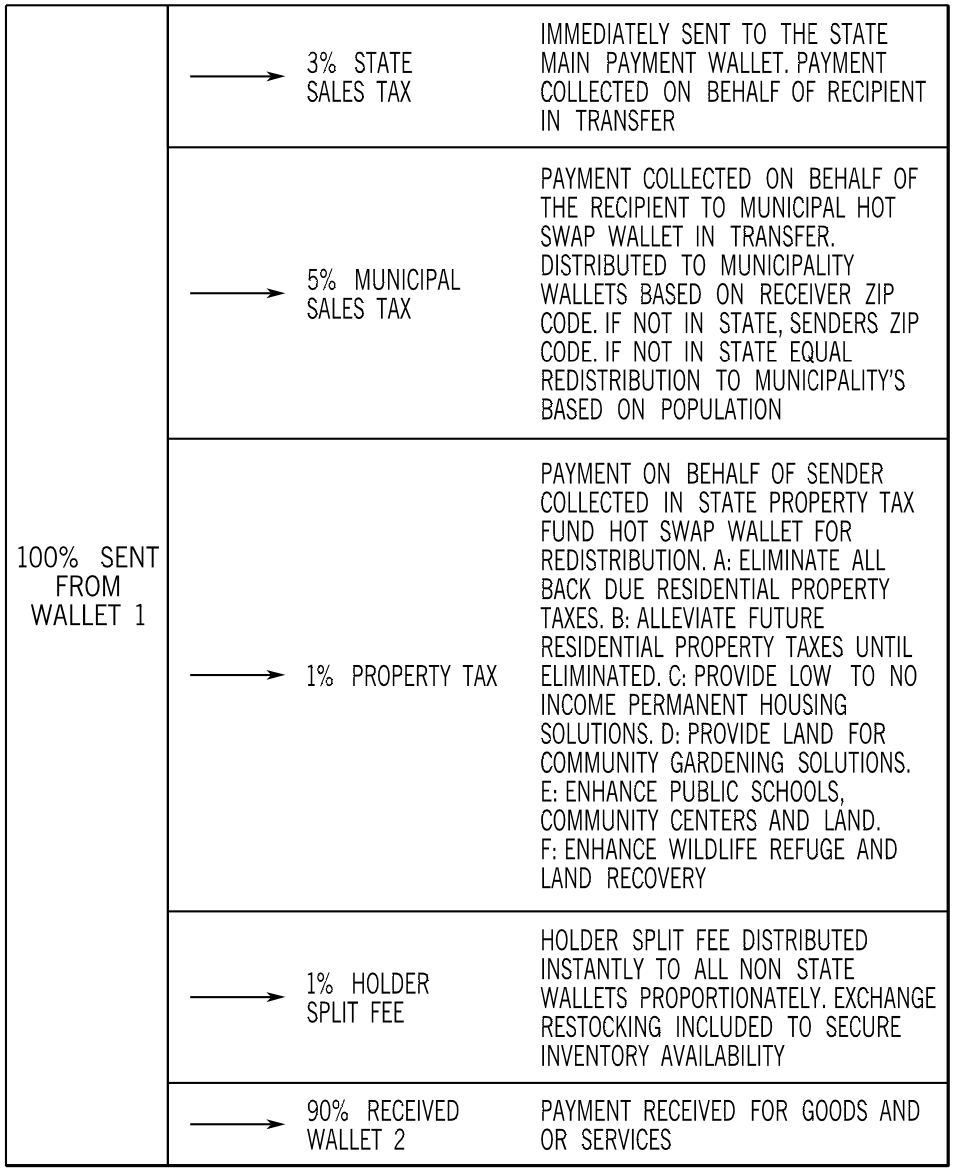

The process does not specify blockchain, tax/fee %, or quantity. I have recommendations of in transfer tax rates for both City and State but ultimately this will come from each State’s recommendations as approved, voted on, then confirmed. My pre-approved State crypto recommendations are as follows:

This is a raise in most cases. Example Colorado state sales tax is 2.9%, and Denver city & county average 4.75%. My recommendation pays off property taxes with sales tax as well as provides future low/no income housing solutions, public school assistance and more. Providing incentive for use through holder proportionate split and wallet hold limits (as mentioned in patent).

All taxes & fees are paid instantly through my crypto system the moment payment is transferred for goods and/or services.

If the County seats continues to exist within a State, cities will pay them tax as appropriate. Otherwise all County compensation will be reassigned to each City jurisdiction based on land responsibility as will duties within the County tax charter.

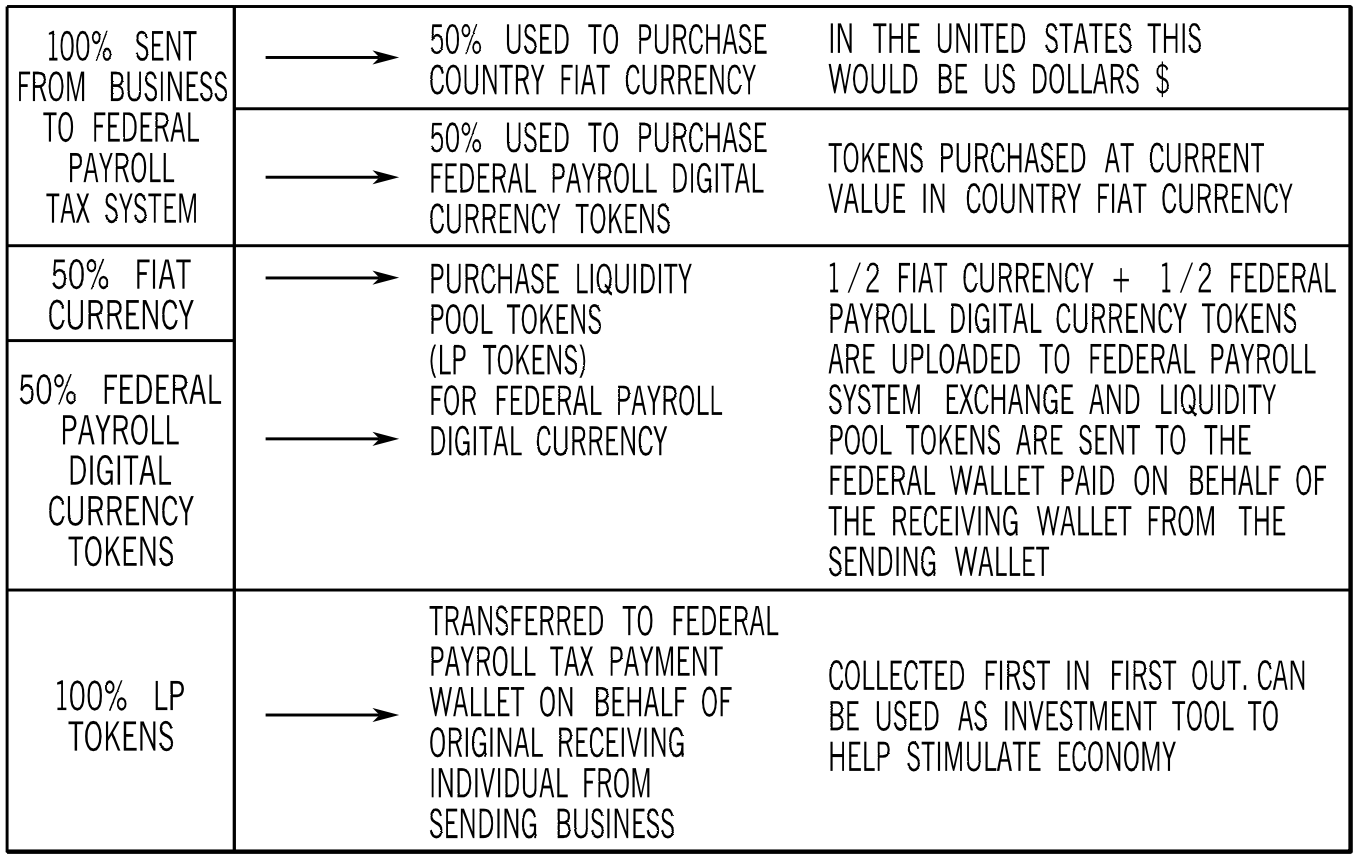

The Federal system will need a bank account as-well to convert crypto to fiat when accepting instant payroll tax payments. Federal crypto token not necessary.

A banking partnership with Pershing (BNY Mellon) will provide one billion (USD or equivalent) insured bank accounts for Federal, each City and State. This crypto system will run parallel to the fiat system and convertible at any time to any currency with capital gains taxes and/or fees assessed in fiat currency tax (quarterly?) upon conversion. Otherwise, in transfer sales tax payments are only necessary. No documentation necessary, as in filing taxes, because everything is instantly paid and the entire ledger is public record.

Federal payroll tax idea; crypto/fiat token system;

Federal crypto token system unnecessary for State system existence or payment.

Deflationary Vs. Stable:

The difference is mostly the token faucet or “mint”. Is the token quantity capped at creation or left open for token addition? Open does not necessarily mean all the time, it just means not closed. For frequency of new token addition please reference its white sheet.

“Stable crypto tokens” have an open faucet or are “mintable” as paired with fiat on demand as requested by exchanges. This is a pair one with one liquidity pool creation equation based on fiat exchange rates. Example one US Dollar equals as close to one “USDT” crypto token as possible within the stack equation (blockchain). The amount of euros a “USDT” crypto token is worth would be based on the US Dollar ($) to Euro (€) conversion. In other words if one (1) USD ($) = one point two three (1.23) Euros (€) then one “USDT” (crypto) would equal $1 or €1.23 (fiat). When an exchange requires 1000 “USDT” (crypto) it’s purchased with 1000 USD (or equivalent fiat alternative) every time, no matter what. Many times there are transaction fees.

Most “Deflationary crypto tokens” have a capped faucet, or fixed quantity. Example twenty one million bitcoin’s. There can never be more added without extreme value change. For the recalculation upon addition will deflate in value based on quantity instead of demand. Example; If 21 million bitcoins has a demand value of $500 million USD (or alternative fiat equivalent), and 1 million bitcoins are added to the total quantity they must be paired with $23.8… million USD (or equivalent fiat alternative) to maintain demand value or the price will deflate. For now 22 million bitcoins are worth the $500 million USD total instead of what should be $523.8… million in demand value, deflating the value with additional tokens. The fact that there will never be more added along with popularity and acceptance drives the value of most deflationary tokens.

Deflationary crypto tokens may add tokens based on its standard operating procedures also known as white paper. This may be event based or passage of time (ie Daily, weekly, etc) as detailed. Fund raising tokens are created within this model and most are deemed worthless after purchase because the fund raiser removes the fiat “donation” from the liquidity pool after transfer. Many scams fall into this version of the deflationary model.

The joke crypto Doge falls into this category. Adding 10,000 tokens hourly with yearly new issuance limited to 5 billion tokens. With an open, time based faucet, as demand drops off dilution starts occurring quickly. Example Doge spiked to about $0.78 (USD) per token with popularity. Since Doge has continued to dilute and fall in price. Doge is currently priced at around $0.14 (USD) per token on 04/11/2022. Doge IS NOT a stable token. More tokens are added hourly to the liquidity pool without matching paired fiat (USD, etc.) constantly diluting value. Doge operates on the litecoin blockchain.

Shiba Inu crypto started with an extremely high token count in the ++ trillions, worth almost nothing, however capped. Different portions of the Shiba Inu crypto network burn tokens (delete them from existence) for different reasons based on the white paper description. Upon each burn the total token count is diminished by the quantity burned. Shiba Inu IS NOT a stable token. Shiba Inu operates on the Ethereum blockchain.

Bitcoin, Doge and Shiba Inu are industry standard versions of deflationary tokens and priced based upon demand. USDT is an industry standard version of a stable token and priced based on one to one.

Both versions of crypto tokens; deflationary and stable, have the ability to be taxed in transfer. The price of deflationary is based on white sheet and demand. (Prices on 4/11/2022; 1 bitcoin = $41,196.20 USD / 1 Litecoin = $105.08 USD / 1 Ethereum = $3,061.03 USD / 1 doge = $0.14 USD / 1 Shiba Inu = $0.00002342 USD) The price of stable is based on exchange pairing (1 USDT = $1 USD). Exchange, transaction, and/or transfer fees may apply.

In Transfer Vs. Fiat Conversion:

Taxing Crypto in transfer means the moment someone buys anything (soda, new cell phone, car, donut, pays a bill, etc.) with the new State crypto the State & City will have the tax payment. In seamless, closed loop fashion they may issue the crypto back to businesses & individuals through things like grants or food stamps as use for legal tender. All of the tax calculations and payments in are instant and extremely verified. Current crypto not applicable. The current crypto system relies on fiat conversion for tax payments. The one country (El Salvador) that has integrated bitcoin as legal tender, has done so tax free.

Fiat conversion means sell to the crypto on an exchange for fiat currency (USD, Euro, etc.); Pay capital gains taxes or write off loss after sale (quarterly-yearly); Sales, property tax & others are paid or written off quarterly by businesses & home owners; A large margin of error including but not limited to analog paper payments and reporting, if documented.

This is a continued documentation of works in progress. I present facts, statistics and my opinions. Any investment advice you derive from within is your entitled opinion.

Darren Lyman – 04/11/2022 – Denver, Colorado, USA